The demand for PCB in automobiles is increasing in both price and quantity

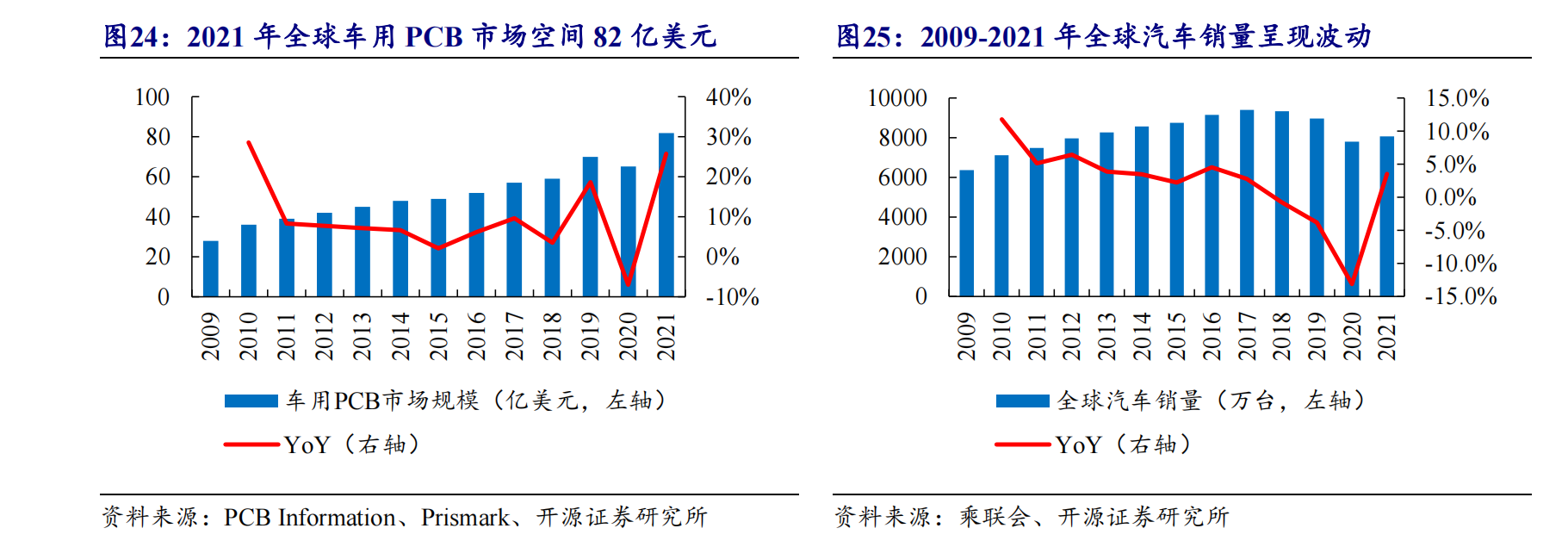

Automotive is the fourth largest application of PCB downstream. According to Prismark statistics, about 12% of global PCB demand in 2018 came from automotive, with an output value of about 7.6 billion US dollars. Benefiting from the rapid growth of downstream automotive electronics demand, the value of automotive PCB has increased. The annual growth rate of automotive electronics PCB is faster than the overall level of the industry. The global automotive PCB market space is 8.2 billion US dollars in 2021, and the average unit price has increased from 56.0 US dollars in 2015 to 101.3 US dollars in 2021.

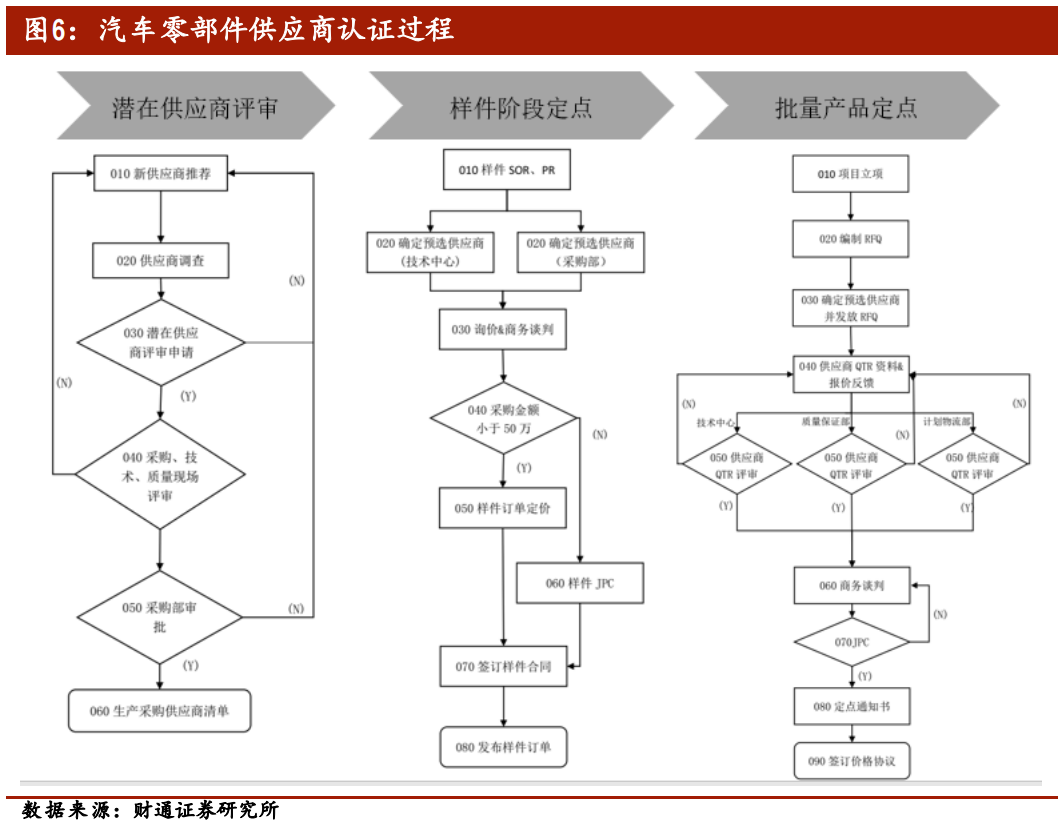

Supplier management of PCB for automotive

Diversified demand for automotive PCB

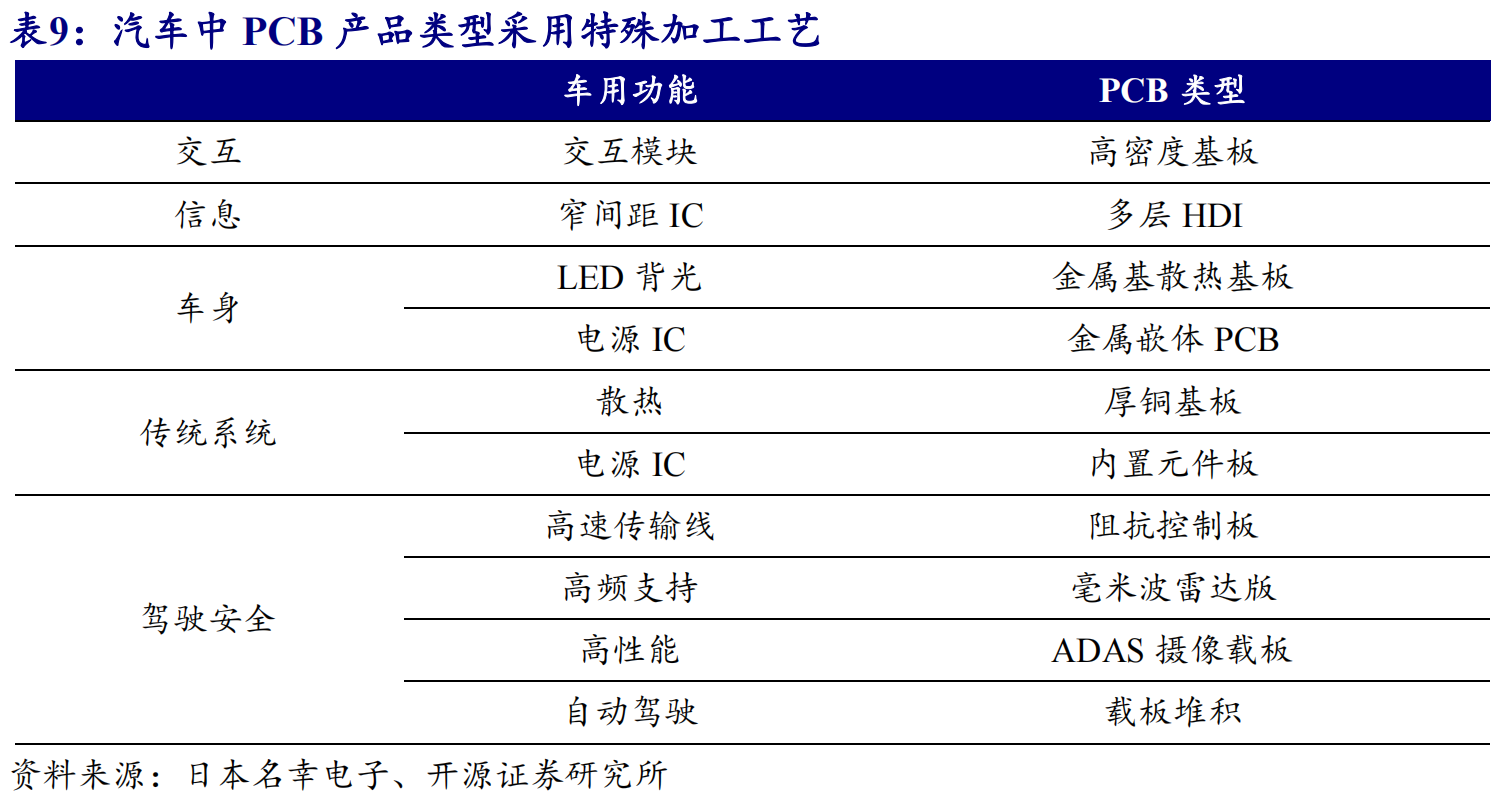

Automotive electronics have diverse requirements for PCBs, with a large volume of low-price products coexisting with high reliability/safety requirements. Hard boards are widely used in applications such as instrument panels, car audio, and driving computers; in engine rooms, due to high temperature environments and LED light source cooling requirements, cooling substrates account for a higher proportion; in high-frequency transmission and wireless radar detection, low-temperature co-fired ceramics (LTCC) are widely used.

PCB design trends for new energy vehicles

The great heat dissipation challenge brought by 800V high voltage

800V high-voltage fast charging will become the mainstream solution. After the charging power of electric vehicles is increased, it is necessary to design conductive components and determine dimensions without overloading, overheating, or controlled derating of charging current. At this time, thick copper or embedded copper solutions are often used: thick copper PCBs with high multi-layering, introducing buried copper and embedded copper processes to increase heat dissipation.

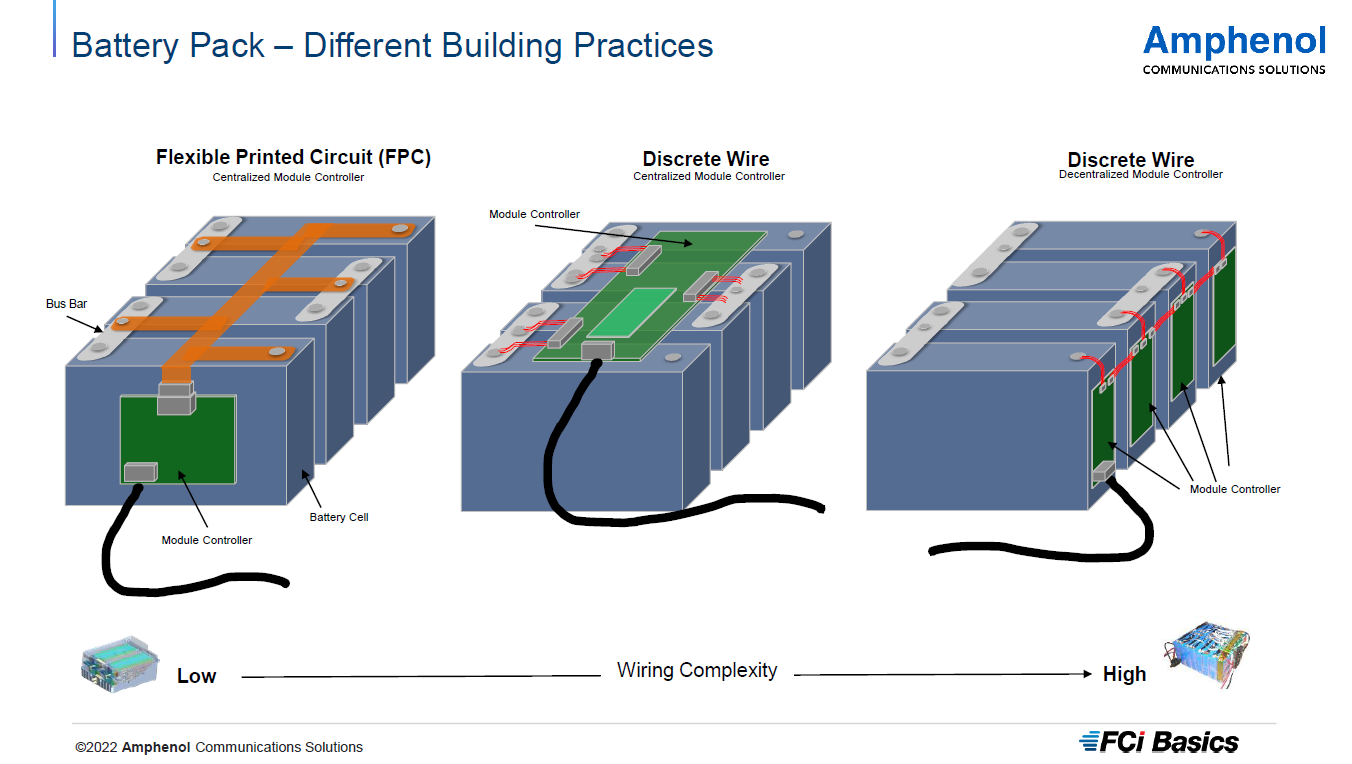

Lightweight requirements for automotive BMS systems

In battery modules managed by the power battery BMS, FPC is used to replace wire harnesses, thereby achieving the goal of lightweighting and space saving.

High-level autonomous driving requires a powerful perception system

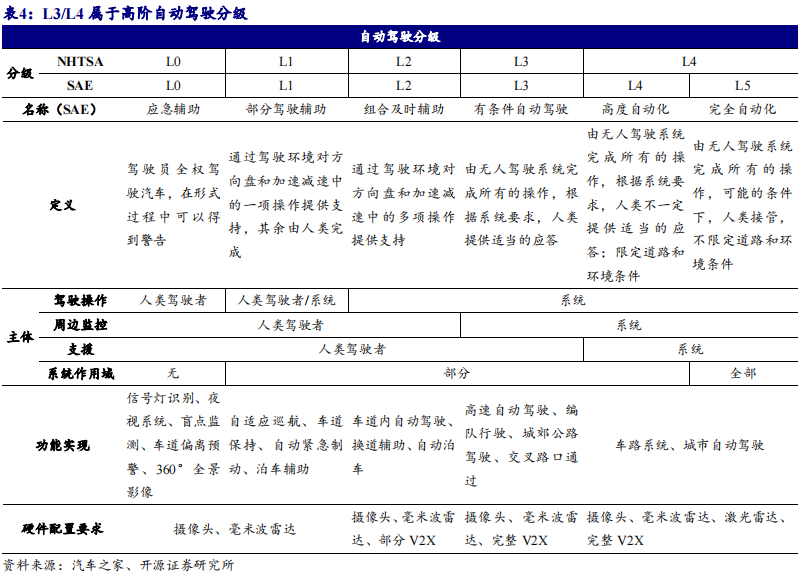

The legislation related to autonomous driving is constantly improving, the L3 landing restrictions are lifted, and L4 is expected to land in 2024-2025. At the technical level, perception + decision-making is the core, and hardware + algorithm technology continues to advance. The level of autonomous driving has moved towards L4.

The high-order auto drive system consists of three parts: the perception layer, the decision-making layer and the executive layer. Among them, the perception layer consists of camera CIS and radar transceiver, the decision-making layer consists of camera ISP and signal processor, and the execution layer consists of various execution modules. The significant increase in sensors will drive the growing demand for rigid-flex (soft-hard bonding) and high-frequency boards.

Intelligent cockpit requires high-level HDI PCB

The intelligent cockpit in the car integrates multiple different operating systems and security levels to meet multimodal human-computer interaction such as touch/intelligent voice/visual recognition/intelligent display. AR-HUD, electronic exterior rearview mirror and other solutions emerge. Highly integrated and super computing performance drive the increase in HDI usage. PCBs for core links such as in-vehicle entertainment systems, autonomous driving main controllers, and in-vehicle servers often use high-speed materials and 3-level HDI designs with more than 10 layers.

智电驱动,驶向光明未来-财通证券[彭勇,赵成,管正月]

Note: The above content is collated from the Internet, and the copyright belongs to the original author. If there is any infringement, please contact us for deletion.